In my previous blog post, I explained how useful, interesting, and entertaining blog posts can help financial brands show off their expertise, build trust, and ultimately sell more products.

But the truth is: this probably isn’t enough.

Nearly every financial company under the sun has woken up to the advantages of publishing useful articles. Most of them are winning their audience over with helpful infographics and content too.

Meanwhile, the very best publishers are making the most of web coding experts to create interactive experiences to make their content even more useful. This type of content, which typically provides tailored advice based on an individual user’s unique financial circumstances, can engage customers more than any other medium.

It is far more useful than generic advice and leaves the reader with the exact information they need to make the best financial decision for their needs.

The bar has been set. This is the new standard of online financial guidance. This is the type of remarkable content that gets enough links and social media shares to send it flying to the top of Google’s searching engine results pages. Anything less is forgettable – and that’s no good when you’re trying to create an army of loyal readers.

That means it’s time for financial companies to think what kind of interactive content could serve their customers even better.

The best way to stir your imaginations is to show you some of my favourite examples of how interactive content can bring a web page to life.

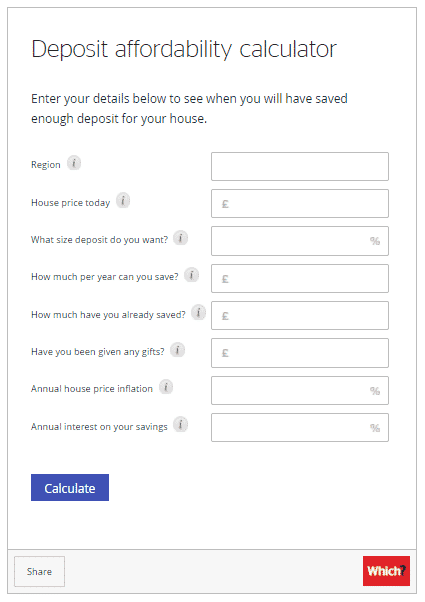

Example #1 Which? mortgage calculator

Let’s pretend you’re a first-time homebuyer who is curious about how expensive a property you can afford. A good web page would tell them that the average home buyer in the Canada will be able to borrow four to five times their annual income from a mortgage lender – and that they should add this amount to their deposit in order to get their maximum budget for house. It would also warn that they’d need to put down at least 5% of the house’s total value

A great web page would tell them that if put $500 a month towards their deposit, they could be able to get a 95% mortgage for a $200,000 house in 20 months (provided their income was at least $38,000 a year).

A brilliant web page, like this one from Which?, would allow them to enter their current circumstances and work it out for themselves. This calculator even accounts for interest on your savings and annual house price inflation.

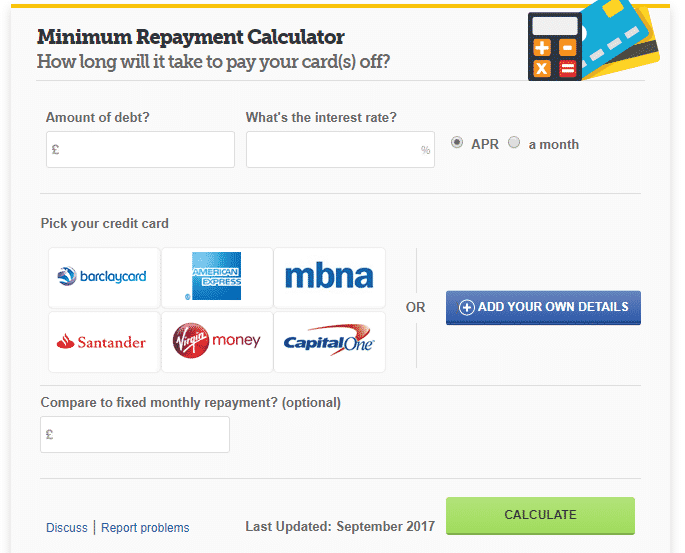

Example #2 Credit card calculator

A good web page would tell you it’s always recommended to pay off your credit card debt in full every month, so that you’re not hit with punitive charges.

A great web page would tell you that it’ll take 27 years and 4 months to pay off $3,000 worth of credit card debt by making the minimum repayments at 17.9% APR – and you’ll pay $4,000 worth of interest!? That’s enough to put anyone off from doing that, right?

However, a brilliant web page, like this one from Money Saving Expert, will let a credit card user type in their own details and work out for themselves how long it will take them to be debt-free

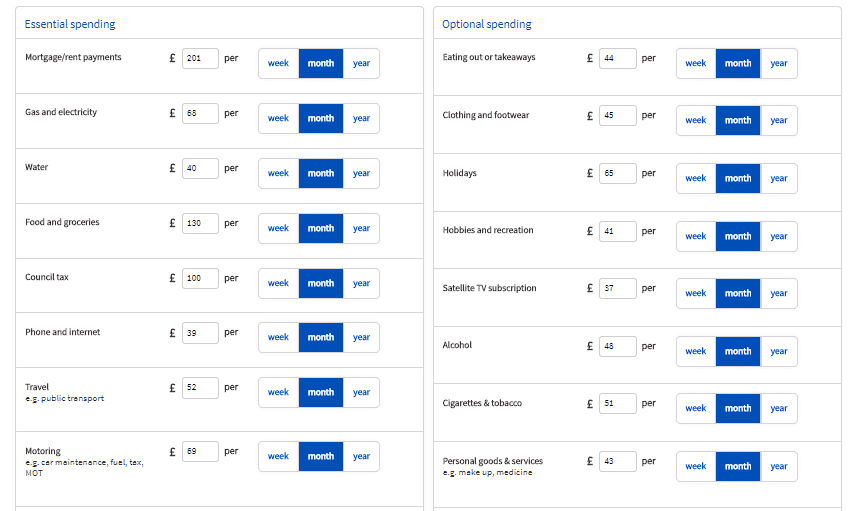

Example #3 Budgeting calculator

A good web page will tell people it’s important to create a monthly budget, so that you create realistic savings goals.

A great web page will offer tons of useful tips from budgeting experts, so that readers can be inspired to spend their money more efficiently and change their lives!

A brilliant web page, like this one from Aviva, will make an interactive quiz, which helps you identify every single area where you could improve your budgeting skills, leaving in no doubt as to your financial inadequacies and how you can fix them.

Benjamin Franklin famously said: “Tell me and I forget, teach me and I may remember, involve me and I learn.”

So, it’s time to ask yourself: what web pages are you explaining a financial concept, rather than letting your readers work it out for themselves? How you could make them more interactive, more enjoyable and therefore more engaging?

Remember, a ‘brilliant’ web page is actually the new standard. It’s the new ‘average’. When I typed “mortgage calculator” into Google, it spewed up 26.6 million results.

If you have no idea how to create this sort of content, there are plenty of coding experts available that you could outsource this sort of work to.

Mohit Gangrade, an experienced content marketing expert, said: “A lot of companies offer tools such as a calculator to collect leads and subscribers. Once you have filled all the details, you might have to enter your email to receive the results and at the same time subscribe to the brand’s newsletter.”

“Calculators and other such tools take a lot of resources (time and money), so most of your competitors won’t even think about making them. If you, however, make such a tool, you can use it to build backlinks to your website because no one else in your industry offers this tool.”

Click the link to find out more about the article writing services that we offer for financial professionals.

Let Article-Writing.co do the work for you

We are an experienced company with a writing team that has been the antithesis of each of these mistakes.

It isn’t easy to find talented, reliable writers that do extensive research and provide the best content, but by avoiding the mistakes above, we’ve done it!

Outsource your blog writing needs to us and you’ll get access to our skilled team of writers and editors, all without you having to go through the rigorous hiring process.

David is the Founder and Director of article-writing.co, the fastest-growing content creation agency in North America. He has transformed companies by offering high-quality content that has impacted their SEO ranking, revitalized websites with engaging and industry-relevant blogs and website copy, and championed successful email campaign copy.